Latest insight on the UK Rental Market based on Zoopla’s Rental Index

Annual UK rental growth increases outside London.

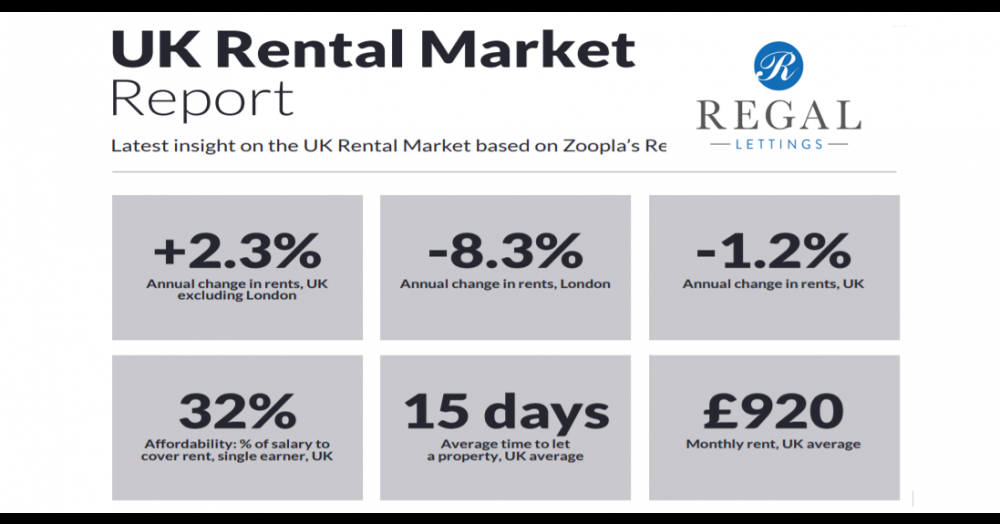

Average rents across the UK excluding London rose by 1.4% in the three months to the end of December, taking the annual growth in rents to 2.3%.

This compares to rental growth of 1.6% seen at the end of Q3 last year. Rents are rising year-on-year in most regions across the UK, with the exception of the West Midlands (0%) and London.

Average rents in London continue to fall. Rents declined by -2.5% in Q4 2020, taking the annual fall to -8.3%, nearly matching the rental declines seen in the aftermath of the Global Financial Crisis in 2008. Average rents in London are at levels last seen in 2014.

Demand and supply

Across the UK, demand for rental property is still rising, with total demand from renters in January some 21% higher than the same month last year.

At the same time, the supply of homes to let is more constrained, falling by 11% over the same period, and putting upward pressure on rents in many areas.

Demand in some well-connected towns across the country is putting particular upwards pressure on rents, with rental growth of more than 7% seen during 2020 in Rochdale (+8.2%), Hastings (+8.0%) and Mansfield (+7.1%).

This trend is reversed in London, as rental supply outpaces demand, as more stock continues to come back to the market amid the changing working, commuting, tourism and business travel trends prompted by the COVID-19 pandemic and subsequent lockdowns.

The City ‘Halo’ Effect

While the general trend for rents outside London is upwards, in some major cities, rental declines are now becoming more entrenched. Rents are falling in Manchester (-0.9%) and Birmingham (-0.8%) while Leeds has moved from +1% annual growth at the end of Q3 2020 to zero growth at the end of the year.

Edinburgh and Aberdeen are also seeing rental declines (see map page 7). A notable trend is that the negative pressure on rents is really concentrated towards the central zones of cities.

In contrast, there is solid rental growth in the neighbouring boroughs – the wider commuter-zone, creating a ‘halo’ effect. For example, rents in central Birmingham (local authority) fell by -3.4% in the year to December 2020, but average rents across neighbouring boroughs, including Bromsgrove, Sandwell and Wolverhampton, rose by an average of 5.3%.

Increased supply of rental homes

There are different factors underlying the trends across the UK cities. In London and Edinburgh, the increased supply of rental property has been a key driver of negative pressure on rents.

During the first lockdown, there was a sharp rise in supply of rental properties prompted by the sudden change in landscape for short-term lets amid falling tourism and commuting. This stock transferred into the long-term rental market, creating a bulge in stock volumes, especially in central zones.

The rise of working from home which has gained traction throughout 2020, also means that a cohort of workers who typically rent in the centre of town for work have located elsewhere on a more permanent basis, meaning more stock coming back to the market rather than rolling over into a new rental contract.

This has put particular downward pressure on rents in central London, where the rental market is more dense. Rents in the City of London fell by -17.3% last year, while rents in Kensington & Chelsea have declined by -12.3%.

However, the rise in supply of rented property has been more muted in other cities – rental declines in these urban areas are being driven by different trends.

More demand … for space

In Manchester, Leeds and Birmingham, the growth in demand is notably stronger in the commuting ‘halo’ than in central zones. Changing working patterns are again playing a part here, and the data indicates some office-based renters are ‘looking through’ the current lockdown to the rest of this year and beyond when flexible working likely be entrenched.

Just as in the sales market, the data points to renters looking for homes with more space, indoor and outdoor, stock which is more likely to be found in the wider commuter zones. A comparison of time to let for houses and flats in Q4 2020 compared to the same period in 2019 shows that houses are now renting out more quickly in all cities, with a house taking 26% less time to rent out in Manchester (5 days less).

In contrast, the time taken for flats to rent out has risen in Edinburgh, Leeds and London. Across the country it is taking an average of 30% less time to let out a house than in Q4 2019, while the time to let a flat has remained largely unchanged, taking just 2% less time.

We have also seen that in every region of the country, while rental cuts apply to only a small proportion of listings, a larger proportion of flats than houses are seeing asking rents reduced.

Market outlook

The pandemic has disrupted some of the key drivers of demand in the rental market – including labour mobility, migration and employment growth. Despite this, we have seen a rise in localised demand in some areas, as some renters look to relocate.

The outlook for the rental market, especially in central cities, will depend on how quickly the COVID-19 vaccine is rolled out, and how quickly it can start to have an effect and kick-start a return to more mobility across the country, and internationally.

As this happens, ‘business as usual’ will start to resume in city centres as business activity starts to rise, from the reopening of retail and offices to events spaces, leisure and entertainment facilities. This will likely result in tick-up in demand in city centres, as well as a shift from long-term lets back to short-term lets in some cases, helping to absorb some rental stock - particularly in London.

Flexible working is likely to continue, meaning there may be a permanent shift in priorities for some renters in terms of location and property type. The ‘search for space’ will likely continue, supporting the rental market for family houses.

At a more macro level, rents will be underpinned by continued demand in the sector as lack of mortgage availability for first-time buyers mean some stay in the sector for longer.

In addition, the supply of new homes into the sector from buy-to-let landlords will remain constrained, meaning overall UK supply in this sector will remain limited which will act as a continued support to rental levels.