Utilising the latest data provided by Zoopla, we bring you all you need to know about the Rental Market....

Summary

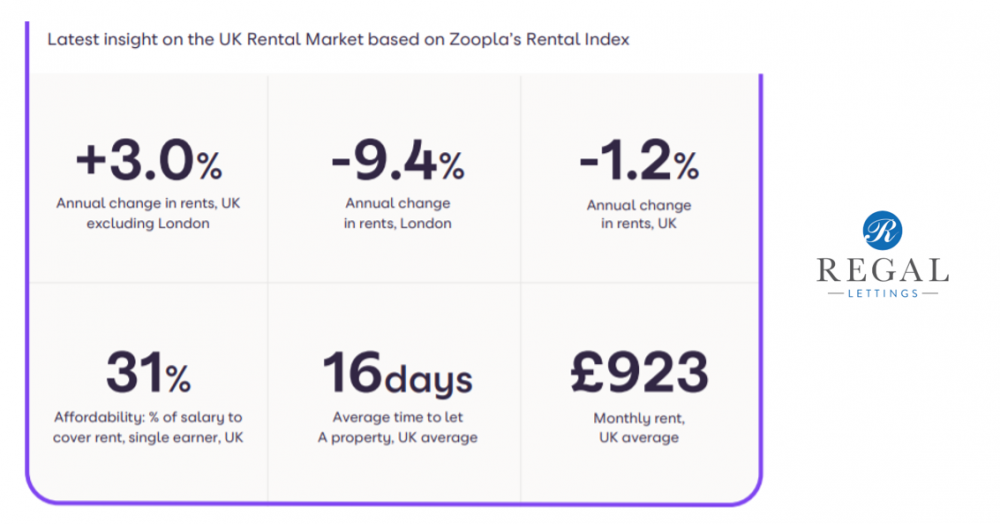

• Three distinct markets are emerging in UK rental market: the wider commuter zones and beyond, major city centres and London

• Across the UK outside London, there is strong rental demand amid constrained supply and rents are up +3% on the year

• Three English regions & Wales are recording the highest rental growth since March 2011

• Rental demand is building in city centres as lockdown eases and offices start to reopen

• In London, rental falls eased in Q1, with rents down -9.4% in the year to March, compared to -10% in the year to February

• Rental demand in inner London boosted as monthly rents in several boroughs hit their lowest levels since the index began in 2011, dramatically increasing affordability

UK rental growth outside London hits 4-year high

Average rents across the UK outside London rose by 1% in the three months to the end of March, taking annual rental growth to +3%. This is an increase from the +2.1% growth at the end of Q4 2020 and

marks the highest level of rental growth in four and half years, amid elevated rental demand.

Rental growth hit a 10-year high in March in the North East, South West, East Midlands and in Wales.

As shown in the chart below, rents are rising fastest in the North East of England (+5.5%), which is one of the most affordable rental markets in the UK.

Rents in the region accounted for a fifth (20.8%) of average income for a single earner in the North East before the pandemic, compared to the UK average of 32%. The growth in rents over the last year has

pushed this measure of affordability to 22%, but it still remains one of the most affordable regions in which to rent a property.

Relative affordability

The relative rental affordability in the regions showing the highest rental growth means there has been more headroom for rents to rise.

For example, in the North East, over the last 10 years, rents have risen by an average of 1% a year, less than the average annual rise in wages.

Rental growth rose to +8% in Barnsley and Wigan in March, two of the towns with the strongest rise in rents over the last 12 months. The rental increase can be compared to the total growth in rents in the

nine years leading up to March 2020 which was around 12%. The average growth in UK rents over the same period was 21%.

In Hastings, the town which has seen the highest rental growth at +8.9%, average rents are relatively lower than the neighbouring towns of Bexhill and Eastbourne, signalling how rents are rising more

quickly here than elsewhere on that stretch of the south coast.

Demand/supply imbalance driving rents

Rental demand was 59% higher in April than in a typical April in the more ‘normal’ markets between 2017 and 2019. In the first quarter of this year, demand for rental property outside London was 32%

higher than in the same period last year.

As with the sales market, more renters are looking for additional space, or are reassessing how and where they are living. This means an increasing number are making moves rather than extending their

lease – creating additional levels of demand. The ‘search for space’ is clear as the share of renters searching for a property with access to or with its own garden has more than doubled this year compared

to the same period last year.

The supply challenge

The data signals that the supply of properties available to rent in most markets is not keeping up with demand. In Q1, the new supply of property coming to the market outside London was 5% lower than in

Q1 last year.

There are several reasons underpinning this. While some renters are making a move, at the same time, a mixture of affordability constraints and reluctance to make larger investment decisions during the pandemic, means the typical flow of renters out of the sector is not happening at the usual pace, putting pressure on supply.

At the same time, investment into the private rental market, which is mostly made up of individual landlords, has not regained the levels seen in 2015 before the additional +3% stamp duty was introduced for investors.

The number of properties purchased using a buy-to-let mortgage was 45% lower in 2020 than in 2015, and the number of homes in the private rented sector has fallen slightly since 2016 as landlords rationalise

their portfolios in the face of tax changes and additional regulation.

In some markets, institutional investors and large-scale landlords are addressing this shortfall. But in many markets outside large cities, supply constraints will remain – and will remain a structural challenge

for the rental market for the foreseeable future.

Demand builds from a lower base in city centres

Last year, relatively muted demand in city centres amid rising stock levels put downward pressure on rents, while elevated demand in the wider commuter zones supported strong rental growth. We

examined this trend in some detail in our previous rental report.

Rents are still down on the year in central Manchester (-1.1%), central Leeds (-0.7%) and in central Edinburgh (-3.2%) in the year to March.

London is examined in more detail later in the report. As lockdown eases and offices and amenities start to open up, there are clear signs that demand for rental property in these major city

centres has started to bounce back in April.

Since Easter (April 5th), tenant demand has risen sharply in central Edinburgh, up 26% compared to the previous six week period. In central Leeds, rental demand is up 7%, while in Manchester, demand is up 5%.

There is a seasonal element to this trend, as the market starts to build towards the typically busy period in late summer. Yet the rise in demand in these central city zones has outpaced the growth in

wider commuter zones over the same period, as the chart below shows.

Affordability has also improved in most cities, with rents in Manchester now accounting for 28% of an average earner’s income, down from 30% in March 2019.

The exception to this demand story is Birmingham, where demand has slowed since Easter – after a much stronger period through February and March across the wider city. Rental growth in Birmingham has nudged back into positive territory at +0.1%.

Market Outlook

Elevated levels of demand in the wider UK market, amid constrained supply, will continue to underpin rental growth this year. The increased availability of mortgages for those with lower deposits may result in more people leaving the sector to buy their first home through 2021, but the wider economic uncertainty will limit this trend.

At the same time, the opening up of the economy and the slow return to ‘business as usual’ as the vaccine rolls out means demand will continue to build over the summer as more people move to rent their first property – although, as ever, this will be dependent on the economy opening up in line with the planned timetable.

Demand will continue to rise in city centres as offices start to reopen and this, coupled with increased affordability levels in many cases, will start to counter the negative pressure on rents seen over

the last 12 months.

In London, where rents are down 9.4% on the year, a modest reversal in rental declines has begun, but it will be a slow build back to pre-pandemic levels in inner London.

The recovery will be uneven and we expect new or recently refurbished properties to attract higher levels of demand in H2.

Landlords if you have any question about the local market do not hesitate to contact us.

01227 763888 - Canterbury

01304 611227 - Sandwich

01304 809800 - Dover